How NVIDIA and OpenAI Are Building a Duopoly and Why the History Books Already Have the Ending

While reading a Reuters exclusive article, I began to see a pattern. Something just didn’t sit right with me. So I did what I always do: looked for a thread to pull.

Turned out it was a long thread. Here’s where I began:

September 22, 2025. NVIDIA announces it “intends to invest up to $100 billion” in OpenAI. Two qualifiers in one sentence – “intends” and “up to” – buried in a headline designed to make people feel like the future just got decided. The tech press ran with it. Breathless. Celebratory. Nobody asked the obvious question:

What does a $100 billion investment from the company that makes the chips look like when the company receiving it has to spend most of that money buying those same chips back?

That question is the thread. Pull it, and the whole thing unravels.

The Timeline. Just the Facts.

September 22, 2025: NVIDIA announces the “letter of intent.” Not a commitment. An intent. To invest “up to” $100 billion. Two qualifiers doing heavy lifting in one sentence.

October 2025: Microsoft delivers GB300 GPU clusters to OpenAI for training a multitrillion-parameter model. NVIDIA hardware. OpenAI compute.

December 2025: NVIDIA acquires Groq for $20 billion. Groq is the company OpenAI was actively in negotiations with for alternative inference chips. The acquisition swallowed the negotiation.

January 30, 2026: The Wall Street Journal reports the $100 billion deal has stalled. NVIDIA has internal doubts about OpenAI’s competitive edge.

January 31, 2026: Jensen Huang (co-founder, president and CEO of NVIDIA) calls the tension reports “nonsense.” Confirms NVIDIA’s participation in OpenAI’s funding round. Clarifies the $100 billion was “never a commitment.” Says NVIDIA will invest a “huge” amount. Just not anything close to $100 billion.

February 2, 2026: Reuters publishes an exclusive: OpenAI is dissatisfied with NVIDIA’s inference chips and has been quietly shopping alternatives – AMD, Cerebras, Groq. Groq, of course, no longer exists as an independent company.

The CUDA Monopoly: Why You Can’t Just Switch

To understand what’s actually happening here, you need to understand CUDA.

CUDA – Compute Unified Device Architecture – is NVIDIA’s programming platform. Launched in 2006, before anyone outside of a graphics lab cared about GPU computing, it was a speculative bet on a future that hadn’t arrived yet.

When deep learning exploded, CUDA was already mature. Over 4 million developers. Every major AI framework – PyTorch, TensorFlow, JAX, Keras – built on top of it. The entire AI industry’s software stack runs on NVIDIA’s platform.

NVIDIA currently holds 80-90% of the AI chip market and 92% of discrete GPU market share as of Q1 2025.

Here’s the part people miss: switching away from NVIDIA isn’t just a hardware problem. In the chip world, it’s an ecosystem problem. Rewriting AI systems for AMD’s ROCm or Intel’s oneAPI isn’t like buying a different brand of car.

It’s like discovering that every road on earth was built for one tire size, and you want to drive something with a different wheel.

That’s why every alternative OpenAI pursues – AMD, Cerebras, Groq – has to fight uphill against CUDA, even before NVIDIA starts writing checks and buying competitors. Because NVIDIA wrote the language the chip race runs in before anyone even knew there’d be a race to win.

The Closed Loop: Follow the Money

Now here’s where it gets interesting.

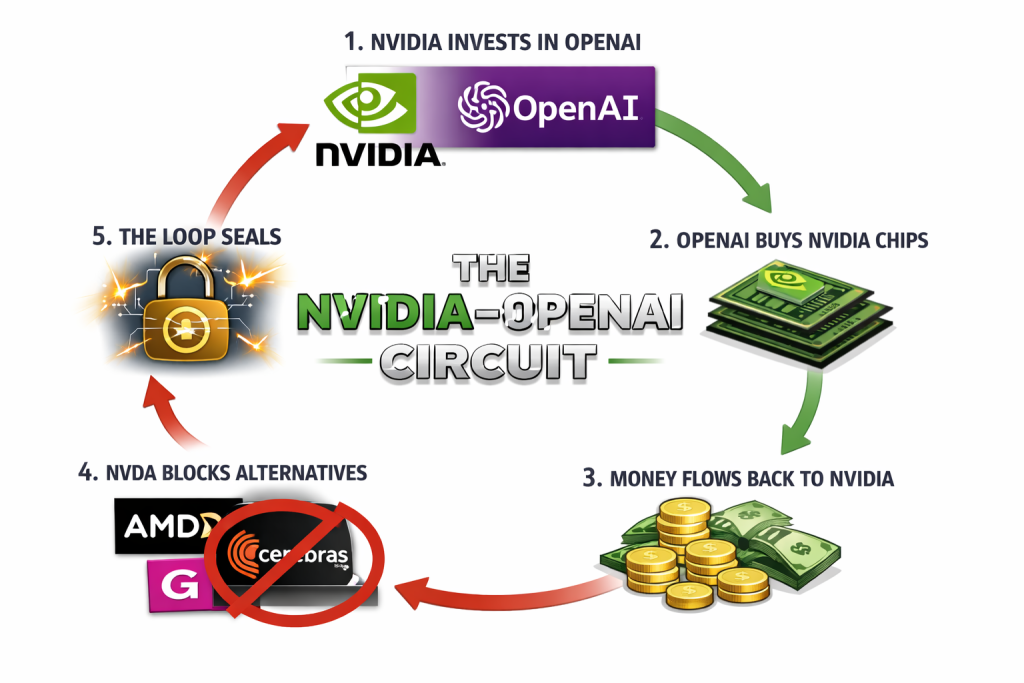

The structure of the NVIDIA-OpenAI relationship isn’t a partnership in the most widely assumed meaning of that word; it’s a circuit.

- NVIDIA invests in OpenAI.

- OpenAI uses that capital to purchase NVIDIA chips.

- The money flows back to NVIDIA.

- When OpenAI explores alternatives – AMD, Cerebras, Groq – NVIDIA acquires or neutralizes them.

- The loop seals.

OpenAI’s CFO Sarah Friar confirmed the loop plainly: NVIDIA’s equity gets “jumpstarted,” but “importantly, they will get paid for all those chips as those chips get deployed.” Most of the investment cash flows back to lease NVIDIA hardware. This isn’t a secret, but their public business model.

When your largest supplier is also your investor and your competitor’s acquirer, “customer” isn’t really the right word anymore. You’ve become part of their balance sheet strategy.

Put bluntly: NVIDIA is funding the demand for its own monopoly hardware, and OpenAI is becoming the keystone customer that keeps that loop spinning.

OpenAI’s Other Deals. Context Matters.

OpenAI isn’t sitting still. They’re hedging. Quietly. And here’s how:

AMD: A multi-gigawatt GPU deployment across multiple years. NVIDIA competitor. OpenAI also secured a warrant for up to 160 million AMD shares – roughly 10% of the company.

Cerebras: A 750-megawatt deployment through 2028. Cerebras claims 15x faster inference for coding tasks than standard GPU approaches.

Broadcom: A custom AI chip design partnership, manufactured through TSMC.

These are real deals. Billions of dollars’ worth of real deals.

They are also, collectively, a fraction of the NVIDIA relationship. OpenAI is building escape routes while NVIDIA is buying the ones it can reach.

We’ve Been Here Before.

Not similar. Not reminiscent. Here. Exactly here.

Late 1990s. Lucent Technologies is the dominant telecom infrastructure company in the world. They make the switches, the fiber-optic gear, and the hardware that runs the internet. Wall Street loves them. They are, by every metric, the picks-and-shovels play of the dot-com era.

And they are quietly destroying themselves.

Lucent’s playbook: loan money to telecom customers – many of them fragile startups – so those customers can buy Lucent equipment. The loans counted as revenue on Lucent’s income statement. The debt got buried on the balance sheet. Revenue looked incredible. The underlying risk was invisible.

When the bubble burst and those customers defaulted, Lucent wrote off $3.5 billion in bad debt. Their stock crashed from $80 to $2. Market cap went from $258 billion to $15.6 billion. The company lost two-thirds of its workforce. It never truly recovered. Alcatel bought what was left in 2006.

The Numbers That Should Concern You

NVIDIA’s current vendor financing and investment exposure is “2.8x larger relative to revenue than Lucent’s official outstanding loans” at its peak. That’s not a typo. 2.8 times.

And the people sounding the alarm aren’t bloggers or crypto bros. Jim Chanos – the short seller who correctly predicted Enron‘s collapse – has publicly stated that NVIDIA is channeling money into unprofitable companies that then use those funds to buy chips. Michael Burry, who called the 2008 housing crisis, has described it as catastrophically overbuilt supply facing insufficient demand.

One analyst puts it even more bluntly:

This is “the biggest and most dangerous bubble the world has ever seen…17 times bigger than the dot-com bubble and four times bigger than the 2008 real-estate bubble.”

NVIDIA’s market cap currently sits at approximately $4.5 trillion. Larger than AMD, ARM, Broadcom, and Intel combined.

The Wintel Ghost

There’s another historical parallel that deserves attention. Less dramatic than the Lucent collapse, but more instructive about what’s actually being built.

In the 1990s and 2000s, Microsoft’s Windows and Intel controlled the entire PC ecosystem. You needed both to function. No one could meaningfully compete with either, because they were architecturally codependent. The Wintel duopoly lasted two decades before smartphones cracked it open.

NVIDIA and OpenAI are forming the same structure, but worse. Wintel was a de facto duopoly enforced by developer inertia. NVIDIA and OpenAI are heading toward a de jure duopoly enforced by capital structure, ecosystem lock-in, and acquisition strategy.

Wintel was two companies that sometimes pulled in different directions. NVIDIA and OpenAI are a closed loop by design. NVIDIA controls the hardware language. OpenAI controls the AI software lead. Together, they control the entire stack. And NVIDIA is actively acquiring companies that might break the seal.

What Regulators Are Doing About It

Not much that’s visible or specific.

No announced investigation zeroes in on the circular financing loop between NVIDIA and OpenAI. No subpoenas tied to the non-voting shares flowing into chip leases, no public probe into whether the Groq licensing deal (and the “talent grab” that came with it) killed off a live competitor negotiation in real time. No congressional hearing has called out the structure. No fresh FTC or DOJ statement flags this particular closed-loop dynamic as a concern.

The broader picture isn’t silent: The DOJ has been digging into NVIDIA’s overall practices for over a year – exclusivity clauses, bundling, certain acquisitions – and the FTC wrapped its big AI-partnerships inquiry in 2024 with warnings about “circular spending” risks in the cloud-AI world. But nothing in the public record names this NVIDIA-OpenAI money-for-chips cycle or the Groq move as the focus of active enforcement.

The deals themselves are built carefully: non-voting shares. Letters of intent instead of hard contracts. Phrasing that reads like friendly partnership while the economics tighten control. Non-exclusive licenses that still absorb key tech.

None of this is sloppy or accidental. It’s deliberate design – quiet, legal, and effective at keeping the stack locked while staying just inside the lines regulators are currently watching.

If this ever does hit regulators’ radar, it will probably show up in boring contract details: exclusivity in chip supply, acquisitions that box out rival hardware makers, and equity-for-spend deals that quietly lock customers into NVIDIA’s ecosystem.

For now, the silence is the story.

The Pattern

Lucent: dominant infrastructure provider finances customers who buy its own products. Revenue looks extraordinary. Risk is invisible. Bubble bursts. $250 billion in market value evaporates.

NVIDIA: dominant infrastructure provider invests in customers who spend that money buying its chips. Acquires competitors the customers are negotiating with. Revenue looks extraordinary. Risk is, for now, invisible.

The pattern isn’t just similar. It’s the same. Only with bigger numbers and better lawyers.

NVIDIA and OpenAI are building something powerful. But what’s been gnawing at me this whole time is this question: Is anyone watching the circuit before it closes completely? If no one is, the loop will still close and when it does, NVIDIA and OpenAI’s dominance of the stack will be a given.

At that point the live question will be how much room anyone else has left to move.

Leave a Reply

You must be logged in to post a comment.